401k management

If your company has a 401k plan be grateful, it is clear that they are interested in you and retaining you as an employee, particularly if they are willing to provide a match to your contributions. I recommend that you make a full contribution if you can, but at a minimum you should be maximizing your company match

Souping up your 401k

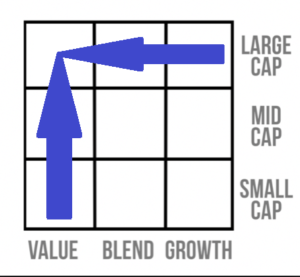

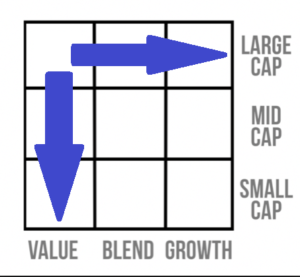

I want to show you something, here is a stock style box, the literature of almost every mutual fund

I want to show you something, here is a stock style box, the literature of almost every mutual fund will have something like this and its purpose is to show you where that fund lies. A well planned 401k plan will have funds in every one of the 9 sections of the box. They do that intentionally so that you will be able to manage your funds accordingly. The only problem is that your typical 401k investor does not know how to use it. I think of it like your car having a turbo button on the dash that makes it go 25% faster without spending more gas, the problem is that nobody knows what it is and how to use it. I know 401k plans inside and out and up and down. I educate you about it and help you to get all the performance that it can provide, your 401k may have features that give your savings growth more horsepower.

will have something like this and its purpose is to show you where that fund lies. A well planned 401k plan will have funds in every one of the 9 sections of the box. They do that intentionally so that you will be able to manage your funds accordingly. The only problem is that your typical 401k investor does not know how to use it. I think of it like your car having a turbo button on the dash that makes it go 25% faster without spending more gas, the problem is that nobody knows what it is and how to use it. I know 401k plans inside and out and up and down. I educate you about it and help you to get all the performance that it can provide, your 401k may have features that give your savings growth more horsepower.

Proper Stock Style Management

What is a Value stock?

What is a Value stock?

To decided what type of company you are looking at, think of what they do with their dividends, or in other words when they earn money and finish paying their bills what do they do with it? (these are called retained earnings.) A value stock will usually pay them out as a dividend to their shareholders. PepsiCo for example, has paid out almost a 3% dividend for many years in a row. If you think about that, in today’s investment environment, that is an excellent fixed rate return. Other examples of Value stocks companies are home depot, General Motors, Coca Cola and General Electric.

What is a Growth stock?

What is Market Capitalization?

That is simply the size of the company, how much is the company worth if you add up all of their assets?

Large Cap – the Company is worth more than $5 billion.

Mid Cap – the company is worth $1 to $5 billion.

Small Cap – the company is worth less than $1 billion

This is the key to what a good Advisor does;

When the market is moving down, we move our clients’ portfolios incrementally towards large cap value.

The Truth; Most people need help

I have seen literally thousands of client’s 401k accounts and how often do you think they are mismanaged? Almost always. I want to show you something, here is a list of fictitious funds on a client account, to illustrate the point

XYZ lifecycle fund 2030 25%

XYZ lifecycle fund 2040 25%

XYZ SP 500 index fund 25%

XYZ Large Cap value fund 25%

Total 100%

First of all hats off to the client for their efforts, but there is a much more profitable way of doing things. A life cycle fund is set up to be the only fund in your account and the number 20xx refers to the year you retire, automatically calculated to be the year that you turn 65. They are there for people who are content to just set it and forget it and take whatever they are given. You can do so much better and my job is to help you.

Roth 401k; saves a ton, in the long run

A Roth 401k; that is an option that allows you to make a much higher contribution than normally you would be able to contribute to a Roth IRA. The way it works is that you make you contribution to your 401k but instead of being pretax it is post tax. In other words your tax bill will probably go up, maybe, maybe not, that’s something we will take a look at together. That’s the cost, here is the payoff, all of that money is tax free for you in retirement. All of it, your contributions and the matching, plus all of the years of growth that that money would accrue between now and the time you retire, tax free. Now that makes sense. As a fiduciary, I have a legal obligation to act in your best interest, and that, is in your best interest. Also, if you have 401k money in a non-roth source we should be looking at conversion. I will help you to do it and calculate and manage the process for you so we don’t accidentally bump you up into a higher tax bracket. That’s the Blue Line way, efficient or nothing.