Simple Fees, and Simple is Beautiful.

Blue Line exists, because there is a Better Way

Blue Line exists, because there is a Better Way

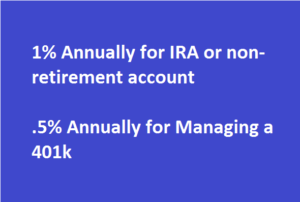

At Blue Line, we earn no commission for products, and you don’t go digging through the paperwork to find our fees. Here they are. Generally, we charge;

We say Generally, because we reserve the right to negotiate the fee if needed. In other words, if there is a legitimate reason that we need to do so, we can adjust the fee up or down. We would do this for example to compete for a client’s account, or if there is an unusually time-consuming situation.

.

Average Expected Returns

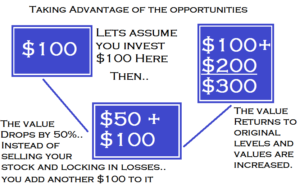

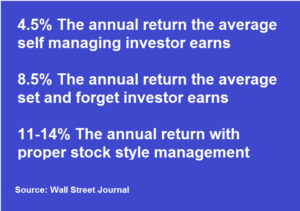

Let me illustrate something for you here. Assume that you had invested $100 in the market at the end of 2007. By the end of 2009 that would have been worth about half as much. Investing more money when it is so far down is exactly the opposite of what most people want to do, but exactly what they should do. I like to use the phrase, “before you through a rock through my window, you better tie another $100 to it because look at what is going to  happen. After just a few years, the market had recovered and for those that held on they gained their money back, but for those that re-adjusted they made much more than their money back, they cashed in on one of the best bull markets in history. Time tested results tell the story. The average mutual fund investor has average returns of approximately 4.5% on a year by year basis. Most get caught trying to outsmart the market and end up selling when the market is low and buying after "things improve". The average annual return of those who are invested in the market and take a long term approach earn on the average 8.5%, more or less the same returns that the S&P has earned over the long run. An investment advisor who manages according to the principles that Blue line uses, will achieve a higher overall rate of return. While past performance never guarantees future results, there is a better way.

happen. After just a few years, the market had recovered and for those that held on they gained their money back, but for those that re-adjusted they made much more than their money back, they cashed in on one of the best bull markets in history. Time tested results tell the story. The average mutual fund investor has average returns of approximately 4.5% on a year by year basis. Most get caught trying to outsmart the market and end up selling when the market is low and buying after "things improve". The average annual return of those who are invested in the market and take a long term approach earn on the average 8.5%, more or less the same returns that the S&P has earned over the long run. An investment advisor who manages according to the principles that Blue line uses, will achieve a higher overall rate of return. While past performance never guarantees future results, there is a better way.