Blue Line is a Financial Fiduciary

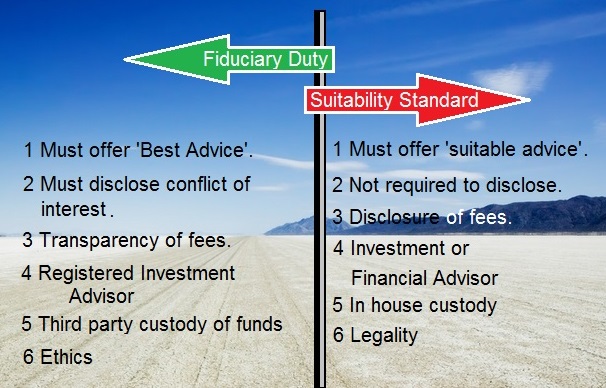

What is the Fiduciary standard?

Under federal law, in particular the Investment Advisers Act of 1940, investment advisers are regulated by the Securities and Exchange Commission (SEC) or appropriate state authorities and are required to provide services to their customers under the fiduciary standard.

It is the highest legal duty of one party to another, it also involves being bound ethically to act in the other's best interests. A fiduciary might be responsible for general well-being, but often it involves finances – managing the assets of another person, or of a group of people, for example

What is the Suitability standard?

(Suitability)' A situation (and sometimes a legal requirement) that an investment strategy meets the objectives and means of an investor. In most parts of the world financial professionals have a duty to take steps that ensure that an investment is suitable for a client.