The Blue Line Planning Process

Services

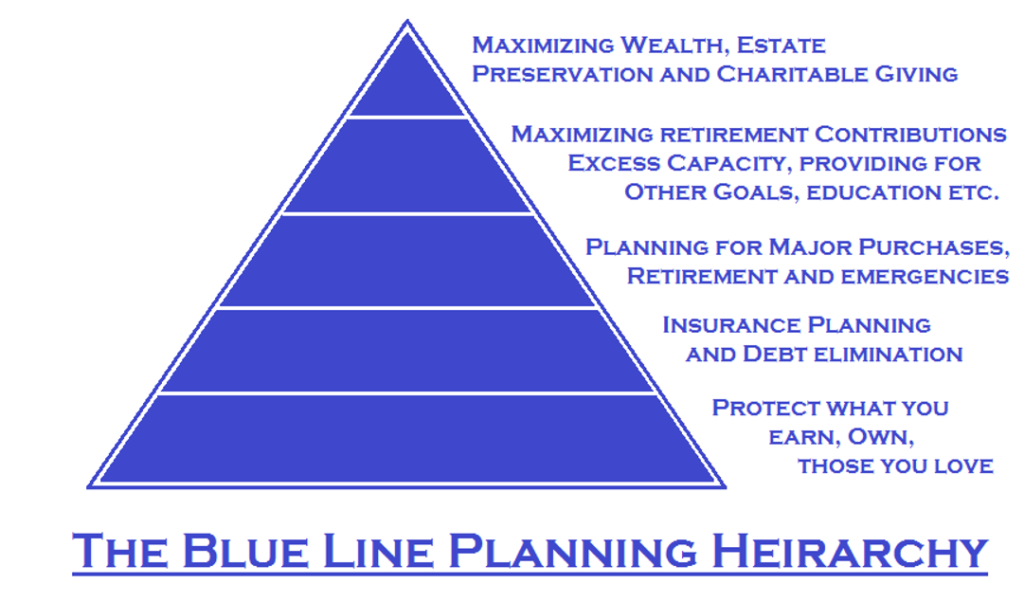

Blue Line Financial planning covers all areas of the client’s financial needs and should result in the achievement of each of the client's goals as required. The scope of  planning would usually include the following:

planning would usually include the following:

- Risk Management and Insurance Planning

- Managing cash flow risks through sound risk management and insurance techniques

- Investment and Planning Issues

- Planning, creating and managing capital accumulation to generate future capital and cash flows for reinvestment and spending, including managing for risk-adjusted returns and to deal with inflation

- Retirement Planning

- Planning to ensure financial independence at retirement including 401Ks, IRAs etc.

- Tax Planning

- Planning for the reduction of tax liabilities and the freeing-up of cash flows for other purposes

- Estate Planning - Planning for the creation, accumulation, conservation and distribution of assets

- Cash Flow and Liability Management - Maintaining and enhancing personal cash flows through debt and lifestyle management

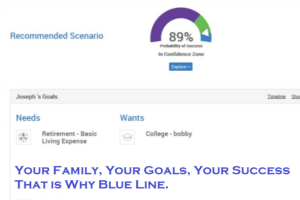

Specific Goal Planning