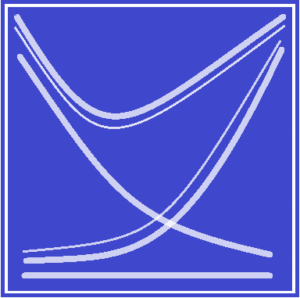

The Blue Line Logo broken down

What is the Blue line? Simply put,

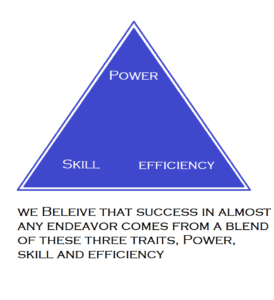

What is the Blue line? Simply put,  it is efficient investing, and more money for you. The Blue Line Logo has several important components and when considered, explains how we make investing more efficient.

it is efficient investing, and more money for you. The Blue Line Logo has several important components and when considered, explains how we make investing more efficient.

First, to establish the basics;

Speed represents money, money is Good, Speed is Good.

Lots of money is Great particularly if you want to do lots of stuff for a long period of time.

Lots of speed is Great, particularly if you want to get somewhere in a short period of time.

Drag is wasted speed, energy and Money.

Wasted speed, energy and money is bad, because it works against everything you are trying to accomplish.

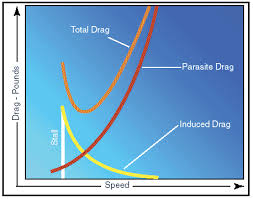

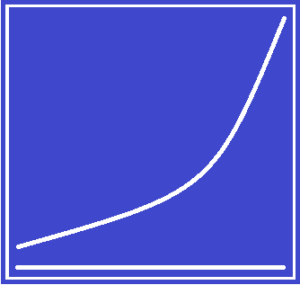

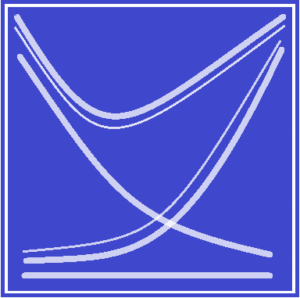

Our logo is a stylization of the Drag Curve which illustrates the relationship between drag, power and speed, as you increase in speed through a medium. The relationship doesn't care about the medium, whether is on the ground, in the air, or on the water. I have chosen it as a symbol for the work that my company does for its clients, and what you as the “driver” of your own situation has to do in order to continue to increase your investment returns in the different phases of your investment life.

Speed is Good, Money is Good

Speed is good, money is good, particularly if you plan on getting anywhere.

The line across the bottom is simple; it represents speed, for us it means money. The farther to the right you move on the line, the faster you are going, or the more money you have. I think we can establish that this is true, whether you are on road, air, water, or even talking about your investing experience.

As you start out, the most important thing is POWER, getting you off the line quick! Getting off to a good start in your investment life makes a tremendous difference.

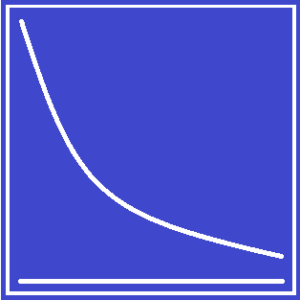

Induced Drag

My job is to help you with the correct distribution so when you add power, you get the best acceleration with your assets.

As you are starting out, you will notice that even though you may be adding lots of power (or dollars), you are not moving very fast. It takes some time to “plane out” or get up to speed. If you have ever driven a boat on the water you know exactly what that feels like. But to continue the analogy, a first-time boat driver can be helped by an experienced one who can set the trim and weight distribution properly, or with a car someone how to apply the cars power to the wheels without spinning them.

The line from the top left to lower right is induced drag. Think of this as the resistance you feel of starting out. In our mechanical analogy, it is the weight of the machine itself and the elements pushing against it. If you have ever had a hard time saving, you are experiencing the effects of this type of resistance. Think of a ski boat when it is just starting out, with its nose high in the water, or an airplane with its flaps and gear down or a car smoking the tires as it leaves the line. But notice that as speed builds, the boat changes angle, the flaps come up and the tires stop smoking. The induced drag goes away dramatically.

Parasite Drag

As your investment advisor, I show you where the sources of Financial Parasite drag are and get rid of them for you, and help you to avoid them in the future.

The line from the lower left to upper right is called Parasite Drag. Notice that the faster you go the bigger Parasite drag gets, again, drag is waste, waste is bad. Did you ever wonder why it is so hard to get a car to go faster than 120mph or so? Parasite drag; now all of that air is pushing on you. Think about it, if you deliver 500 HP to your wheels in your car you top out at 150 or so, if your car is geared for it, right? What happens if you add another 500 HP, do you get to 300mph? No, you don’t, maybe 200. Similarly, as your assets increase, so does the ways that the growth on your wealth can be hampered, or opportunities for growth wasted. Some of those are product related, like using Mutual funds that are loaded, using Annuities (or any insurance product) as an investment, failing to respond to market changes, or failing to handle capital gains properly to name just a few. Other sources of this drag are related to behavior, like unplanned spending or emergencies that come up etc. Sources of Financial parasite drag are many, and often well hidden.

As an investment advisor, I show you where the sources of Financial Parasite drag are and get rid of them for you, and help you to avoid them in the future.

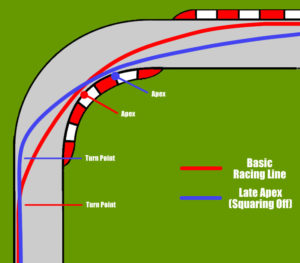

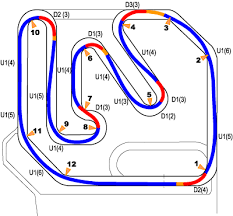

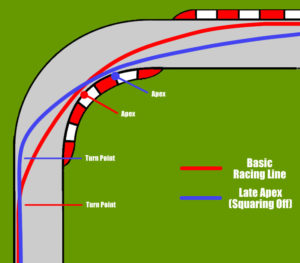

What Racing Teaches us about investing

.

. .

. .

. .

.

Money is Energy, Market Curves, not crashes

Your Financial Gearbox and how it works

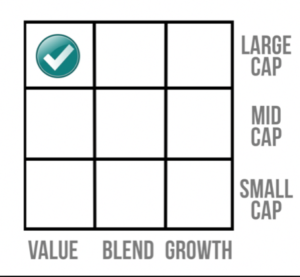

There are several potential definitions of stock styles, but in order to keep this easy to understand and use, we will think about it this way.We make incremental adjustments to the style of stock at the appropriate times

To decided what type of company you are looking at, think of what they do with their dividends, or in other words when they earn money and finish paying their bills what do they do with it? (these are called retained earnings.) A value stock will usually pay them out as a dividend to their shareholders. PepsiCo for example, has paid out almost a 3% dividend for many years in a row. If you think about that, in today’s investment environment, that is an excellent fixed rate return. Other examples of Value stocks companies are home depot, General Motors, Coca Cola and General Electric.

What is a Growth stock?

What is Market Capitalization?

That is simply the size of the company, how much is the company worth if you add up all of their assets?

Large Cap – the Company is worth more than $5 billion.

Mid Cap – the company is worth $1 to $5 billion.

Small Cap – the company is worth less than $1 billion

This is the key to what a good Advisor does;

When the market is moving down, we move our clients’ portfolios incrementally towards large cap value.

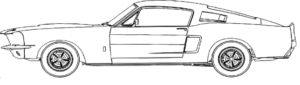

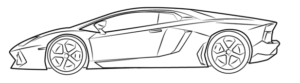

The Blue Line Progression

This is the Blue Line Progression. What I want you to notice here is that as we go from one car to the next, to the next, we are moving along the bottom speed line of the chart to the right. First we are adding power for acceleration, the next car has more power and a lighter engine and more streamlined body. The third car is the fastest and has a body that is shaped to deal with the opposing forces of parasite drag. Each car starting from left to right has its

This is the Blue Line Progression. What I want you to notice here is that as we go from one car to the next, to the next, we are moving along the bottom speed line of the chart to the right. First we are adding power for acceleration, the next car has more power and a lighter engine and more streamlined body. The third car is the fastest and has a body that is shaped to deal with the opposing forces of parasite drag. Each car starting from left to right has its

own set of limitations and problems. In addition to their change in shape, they become lighter and more efficient. What you can see is that their frame is designed to handle air more efficiently. What you cannot see is every internal part is designed to eliminate wasted energy and produce a faster result.

own set of limitations and problems. In addition to their change in shape, they become lighter and more efficient. What you can see is that their frame is designed to handle air more efficiently. What you cannot see is every internal part is designed to eliminate wasted energy and produce a faster result.

This is the Blue Line Progression when you apply it to Finance. Everyone is somewhere along this level, and wherever you are, we will plan together how to get you to the next level. We get you to the next level faster.