Investing with no master plan; Zigging when the road is zagging

Zigging when you should Zag, in other words, investing with no master plan.

Zigging when you should Zag, in other words, investing with no master plan.

How do you respond to market volatility? Most people are aggressive, - provided that the market is going their way. We learned painful lessons about this during 2008 and 2009. When the market changes it goes through several stages. Most people who are working at their normal jobs don’t realize what the current market scenario is or what warning signs to look for. The consequence is that they wake up one day in a falling market, and start listening to the news and decide to sell, thinking they will buy again when the market improves. Only by then it is too late. The average return for this type of person is remarkably positive, but barely ahead of inflation at 4.5%

Day trading

The truth of the matter is that most day traders, do not make money; It’s only 2 out of 12 that do. And those that do average about 8.5% per year according to the Wall Street Journal. You are better off just using an index fund and getting another hobby.

Setting and forgetting

This approach is actually an improvement over the zigging when you should zag approach. It involves choosing an investment, like a mutual fund and putting money into it on a regular basis and looking at it maybe once a year, and not really making any changes. There are a few things that I have seen happen in this scenario; at the end of a long period of time the client finds out he or she was not invested in the way they thought. For example after the market turned around, I talked with a person who had been all in cash in his account. He had never changed anything and had missed out on huge market growth. That isn’t everyone, but illustrates the point. The average rate of return for an investor like this is 8.5%, the same as the S&P 500

There is a better way

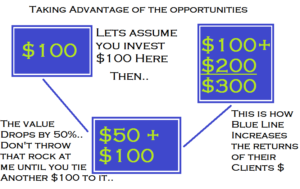

Let me illustrate something for you here. Assume that you had invested $100 in the market at the end of 2007. By the end of 2009 that would have been worth about half as much. Investing more money when it is so far down is exactly the opposite of what most people want to do, but exactly what they should do. I like to use the phrase, “before you through a rock through my window, you better tie another $100 to it because look at what is going to happen. After just a few years, the market had recovered and for those that held on they gained their money back, but for those that re-adjusted they made much more than their money back, they cashed in on one of the best bull markets in history. That is exactly how we are able to get 11-14% for our clients instead of the 4.5% that the average DIY’er is able to do. There is a better way.

Let me illustrate something for you here. Assume that you had invested $100 in the market at the end of 2007. By the end of 2009 that would have been worth about half as much. Investing more money when it is so far down is exactly the opposite of what most people want to do, but exactly what they should do. I like to use the phrase, “before you through a rock through my window, you better tie another $100 to it because look at what is going to happen. After just a few years, the market had recovered and for those that held on they gained their money back, but for those that re-adjusted they made much more than their money back, they cashed in on one of the best bull markets in history. That is exactly how we are able to get 11-14% for our clients instead of the 4.5% that the average DIY’er is able to do. There is a better way.