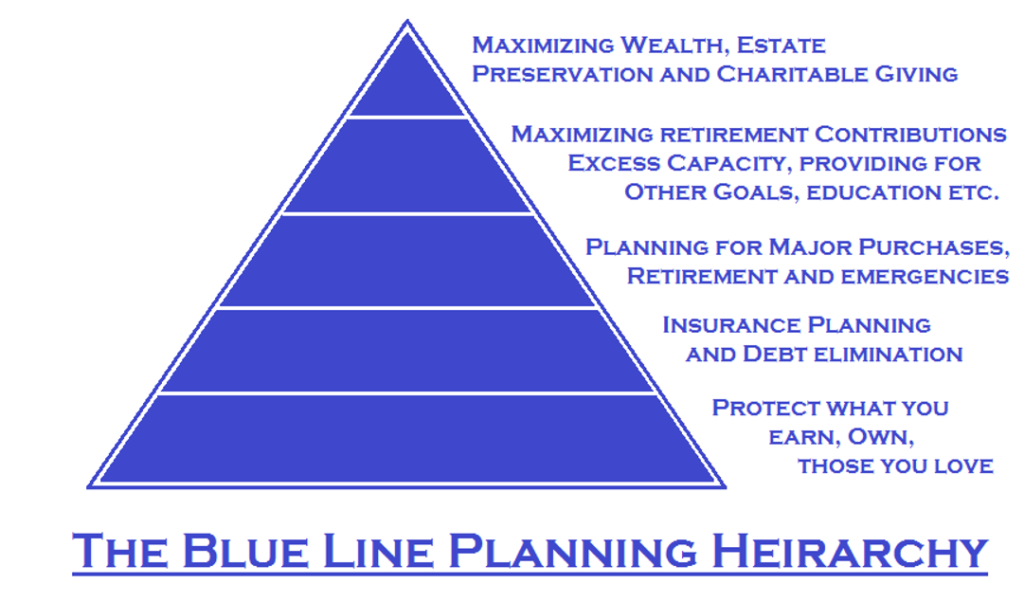

Planning

Planning, The first time that we meet, we will get an idea of where you are today. Take a look at the Blue Line Planning Hierarchy and get a feel for where you might be. My job is to move you upwards in the pyramid. If this is our first time meeting, have an idea of a few things

1 what your goals are. If it is retirement, give some thought to when and how you want it to be

2 what have you done so far to save and prepare

3 family situations

4 an idea of how aggressive an investor you have been so far.

5 Bring all of the decision-makers to the appointment. Not to do so would be an unwise use of time

6 Any specific questions that you have

Rollover

Rollover

To do a rollover we will need a few things,

1 Rollover paperwork from your previous company. If you don’t have it, no problem, we can get it during the appointment. We will need to know for sure where the 401k is, so you will need to bring a statement, or get one to us before the appointment. If we are rolling money into your current company plan, we will likely need some forms from the receiving firm as well.

2 Current statements.

3 We will usually do a conference call with your current 401k record keeper, so bring information about who they are and their contact information. Usually a three-way conference call is necessary, since most firms will not talk with a representative without recorded permission from the client.

Where it gets complicated, there is no standardization of forms and procedures, and all companies have retention efforts, a few are particularly aggressive and most are intentionally confusing. We have the experience and skill to walk through what is sometimes a maze of paperwork

Account Consolidation

Account consolidation, here are the steps to how this is done:

1 First we open the necessary account through Blue Line

2 Second, collect specifics about the other accounts, account numbers, types, holding firms etc

3 Check to make sure mutual funds or other holdings can be held at Charles Schwab, otherwise some funds that cannot transfer will need to be turned to cash first and the cash is sent over to your new account

4 Where it gets complicated, much like rollovers, there is no standardization of forms and procedures, and all companies have retention efforts, a few are particularly aggressive and most are intentionally confusing. We have the experience and skill to walk through what is sometimes a maze of paperwork

Progress Review

Regular Review; This is where we put on our proverbial binoculars and look out on the horizon

1 During our regular review, we will look at progress, review market scenarios and review your goals and make sure we are aware of any changes.

2 Review the ‘star track’ which is a feature of our planning tools, and gives a point to point course on your progress

3 Bring current 401k statements so we are able to track current balances

4 Write down and bring notes on any concerns that you might have