Fund duplication

This is a great example of fund duplication. By that, we are talking about owning many apparently different, mutual funds in an effort to be diversified, but when you look under the hood, they are really the same.

Take a look at this, here is a list of fictitious funds on a client account, to illustrate the point.

XYZ lifecycle fund 2030 25%

XYZ lifecycle fund 2040 25%

XYZ SP 500 index fund 25%

XYZ Large Cap value fund 25%

Total 100%

We think this is a little like using 5 different shopping carts and filling them all with different brands of breakfast cereal. At the end of the day, all you have is breakfast cereal. All of the funds shown have almost identical components when you break them down. We give them the credit for being conscientious and doing their best. There is a better way.

Ignoring the Stock Style

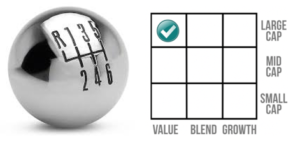

It is Possible you have seen this before as you are browsing through your fund’s paperwork. It will usually show a dot, where your fund is. Most investors will see this and pass it by. It is actually a vital piece of information when designing your plan. This is what we use to determine which funds to use, how much and when, we also use it to decide which adjustments to make in your portfolio. A well-designed 401k plan for example will have a few funds in each section of the box, to facilitate that very purpose, and properly used, it will increase your accounts performance. Like a gearbox in a race car it is to be used with skill. That’s what Blue Line does.

It is Possible you have seen this before as you are browsing through your fund’s paperwork. It will usually show a dot, where your fund is. Most investors will see this and pass it by. It is actually a vital piece of information when designing your plan. This is what we use to determine which funds to use, how much and when, we also use it to decide which adjustments to make in your portfolio. A well-designed 401k plan for example will have a few funds in each section of the box, to facilitate that very purpose, and properly used, it will increase your accounts performance. Like a gearbox in a race car it is to be used with skill. That’s what Blue Line does.

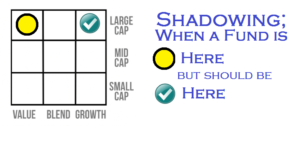

Shadowing

Shadowing. Now that I have explained the correct style of funds, you will understand what shadowing is about. It means a fund that is not where it is supposed to be on the style box. That makes it inaccurate and unusable for managing an individual’s account because it doesn’t do the job it was designed for. This is more common than you might think, and goes to show that even fund managers sometimes chase returns, which no one should do. There is a better way.

Short term trading fees

Short term trading fees. Not all funds have this, but some will and we will find the ones in your portfolio that do. You will see them more in funds that have high turnover  rates, High turnover rates increase the internal costs of the fund. So does investor activity. So the manager needs you to stay for a while so he can keep his costs low and not dilute returns. They vary in amount and length 30 to 270 days, 90 is the most common. Here is the catch with this, whenever you buy new shares of that fund the short term trading fee starts all over again on those new shares. That’s a leak. Even if your funds have these, with a little careful planning it can be avoided.

rates, High turnover rates increase the internal costs of the fund. So does investor activity. So the manager needs you to stay for a while so he can keep his costs low and not dilute returns. They vary in amount and length 30 to 270 days, 90 is the most common. Here is the catch with this, whenever you buy new shares of that fund the short term trading fee starts all over again on those new shares. That’s a leak. Even if your funds have these, with a little careful planning it can be avoided.

loaded mutual funds

Loaded funds – whoever you are, there is no reason to subject yourself to this. I have explained this in other sections but it bears repeating. This is a share of a fund that  pays the salesman 5% either when you buy it or when you sell it, or spreads the fee over the time that you have it. Either way it is a big drain on your performance. There is almost always a version of the loaded mutual fund that you have that has no load. If there is we will use it, or even a institutional class of the fund which is usually reserved for 401k plans and drive your expenses down even further.

pays the salesman 5% either when you buy it or when you sell it, or spreads the fee over the time that you have it. Either way it is a big drain on your performance. There is almost always a version of the loaded mutual fund that you have that has no load. If there is we will use it, or even a institutional class of the fund which is usually reserved for 401k plans and drive your expenses down even further.

A 12b-1 fee is an annual marketing or distribution fee on a mutual fund. The 12b-1 fee is considered to be an operational expense and, as such, is included in a fund's expense ratio. It is generally between 0.25 and 1% (the maximum allowed) of a fund's net assets. Yes, that's a problem, We fix it.

life insurance products used for Investments

Annuities – If you have an annuity we will analyze you situation and determine if an annuity is the proper application in your situation. Most insurance and brokerage firms have great rationalization for why they sell these in the wrong circumstances as a matter of course. As an example, we recently heard of a case where an agent for a local credit union sold an annuity with a 10 year surrender period to a woman in her early 70’s. That’s dangerous and immoral stuff, in the opinion of Blue Line. It’s a little like playing poker in Vegas; so it if you must, but use a little of expendable money and go into it knowing that the cards are stacked against you. Leaks all over the place.

Annuities – If you have an annuity we will analyze you situation and determine if an annuity is the proper application in your situation. Most insurance and brokerage firms have great rationalization for why they sell these in the wrong circumstances as a matter of course. As an example, we recently heard of a case where an agent for a local credit union sold an annuity with a 10 year surrender period to a woman in her early 70’s. That’s dangerous and immoral stuff, in the opinion of Blue Line. It’s a little like playing poker in Vegas; so it if you must, but use a little of expendable money and go into it knowing that the cards are stacked against you. Leaks all over the place.

Variable Universal Life, Universal Life, used as investments. At Blue Line, we will not do this for any reason, because there is no reason. They are insurance products, not investments. This is like a leak that just gets bigger and bigger as time goes on.

Mutual fund mistakes, stopping more losses

The Broker/Dealer and Loaded funds. You may already be familiar with this person, like a car salesman, they earn a commission of your money. There exists here and incentive to sell you what they need to sell you and not what is best for you. The favorite tool of this group is the Class A, B or C mutual funds. That is a known as a front-loaded fund which means that they get between 3% and 5% of the money that you put into the fund and the Broker dealer cannot make needed adjustments to the portfolio without costing you even further. On top of that, the Broker/Dealer does not make any money unless you buy different fund shares. When he recommends you change funds, is that in your best interest, or just churning and taking advantage of your trust? There is a better way.

Using a mutual fund when a low-cost ETF works better. The average Mutual fund has an expense ratio of 1.25%, the average ETF has an expense ratio of .44% which is .81% that you will be paying in expenses or in other words $8.10 for every thousand that you have invested. With a hundred thousand dollars, you are losing $810 dollars per year in opportunity cost by using a mutual fund instead of an ETF that has the same purpose.

Rebalancing and portfolio drift – This has to do with your ratio of stocks to bonds. If you are not rebalancing to your target ratio on a regular basis, you are losing on the average 1% per year in opportunity cost. If rebalancing is not done regularly, you will lose that 1% gain and your account will drift into a more aggressive or conservative position.

losses caused by missed opportunities

Roth Conversion, when you convert money to a Roth Source, you pay the taxes now, but never again on the gains, ever. In our opinion, that makes a lot of sense. That’s one reason we love bear markets, it gives the opportunity to convert at lower share prices and so you pay taxes on the amount while it is depressed amount then it grows the whole time the market recovers. What a great opportunity to save our clients a ton of money in the long run! Parenthetically, the Roth IRA is named for Senator William Roth who introduced it as part of the tax relief act of 1997.

Tax loss harvesting - Tax loss harvesting is the practice of selling a security that has experienced a loss. By realizing, or "harvesting" a loss, investors are able to offset taxes on both gains and income. The sold security is replaced by a similar one, maintaining the optimal asset allocation and expected returns