the 1-800 number, or the Big Box investment firm

The upshot of the 1 800 number

The upshot of the 1 800 number

We could also call this the ‘discount broker’. If you are a DIY person, this is your place to do business. Fidelity, Scottrade, TD Ameritrade and others all have great low-cost platforms for you. They will usually have a convenient 1-800 number for you to call, and likely will have some form of managed account for you to use. If not you will be directed to a lifecycle fund or some other target retirement date fund, or may even recommend to you a list of funds after a portfolio review.

The shortfalls of the 1 800 number.

If you don’t have at least $250k or more you will not get assigned a specific person to deal with. To be honest, they don’t have the time to pay attention to you. I know, I was there and saw it first-hand. Oh sure you will have a good conversation this day or that day, but to have someone really take an interest in your situation and watch things for you long-term, is just not going to happen. The trouble with that situation is, its just too big. Those managers are literally unable to manage accounts for you on an individual basis. If you do get assigned a person you will be one of about 700 people in his “book of clients”.

Account Management at the 1 number, is like driving a car with a Steering wheel, but no Gearbox.

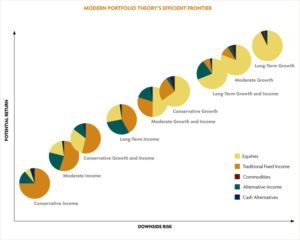

If you do agree to account management your account will be lumped in to one of about 10 different portfolios, depending on how aggressive or conservative you want to be, or when you need the money. There is really nothing individualized about it. I know because I was there and saw and experienced it for 10 years. I remember the moment that I realized what it really was. I was in a team meeting and I heard my Boss who had been a manager for this “managed account” and he said, “ We charge them 1%, but that’s really not for performance, but so that they don’t hurt themselves”. Seriously? Now to be clear, that’s 1% of the balance of the account, on top of the 1.25 % that they are charging you in each of the different mutual funds. Double dipping. There is a better way.

Lucky if you get the same person twice. These companies are set up for scale and profitability. Which means for the client, when you call you are getting to a giant phone system and one of thousands of employees. Do you think you would ever get tired of explaining yourself over and over? At least they share common notes, so that helps. There is a better way.

The Broker Dealer

There are only a few ways to buy investments;

The Broker/Dealer and Loaded funds. You may already be familiar with this person, they are commonly found in strip malls and Banks Since, like a car salesman, they earn a commission of your money. There exists here and incentive to sell you what they need to sell you and not what is best for you. The favorite tool of this group is the Class A, B or C mutual funds. That is a known as a front-loaded fund which means that they get between 3% and 5% of the money that you put into the fund.

The inherent trouble with buying from a broker dealer - its just like buying a car. Your funds depreciate the second you drive off the lot.

It’s the time to recover from the purchase itself. If you give 5% of your investment, right off the bat, then you need that investment to grow by another 7.5% just to breakeven, let alone profit. The average market year will return 8.5 %, so on the average you are giving away almost a year’s worth of profit. Then if you need to rebalance or switch funds the process starts all over again. In addition to that, the broker dealer is incentivized to make exchanges in the account that are not needed, in order to generate his commission. If there is a down market after you buy that fund, then you are in a real fix. You have lost the 5% commission and market losses on top of that. Furthermore, the Broker dealer cannot make adjustments to the portfolio without costing you even further. There is a better way.

The truth about annuities

Annuities, frequently misused – When you see insurance companies on TV advertising retirement planning, this is what they are talking about. This is a situation you can spot because they are usually sold on the basis of their guarantees, such as “guaranteed not to lose money”, or some other iteration of the same idea. The only one that is guaranteed to make money here is the insurance company and the salesman. The commission this person makes is higher than the Broker – Dealer. If you put $100k with this person, he will make $6 or $7 thousand dollars immediately. Does that come from your money? Absolutely it does.

Here is what you need to know;

- Surrender period – Your money is charged a hefty percentage if you withdraw it for a length of time, usually 7 to 10 years. The surrender penalty is guaranteed to be higher than the salesman’s commission.

- Participation rate – that refers to how much you get to keep of the return of the underlying investments of the annuity. Ie; if the investments go up 10%, how much do you get to keep?

- Mortality and expense Fees – they charge you an extra 1.5% in case you die and to run the annuity.

- Fees of underlying funds – Life Insurance companies will use their own mutual funds, each with their own expense ratios, of about 1.25% whether they are highly rated funds or not.

- Settlement options – if you select a beneficiary or a settlement option like period certain, or joint life, it is also going to cost you. If you do not select a settlement option, when you die, they keep all of the money. The only way to win this game is to live longer than the actuaries think you will, then you might get back some of the fees they have charged you for the previous 30 years.

To be frank about it, at Blue Line we have a moral issue with most annuity companies and their "retirement planners". There are only a few correct applications for an annuity, which is the reason that we offer them, but we do not make a commission beyond my normal, simple, and low fee.

There is a better way

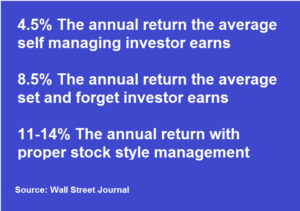

Average Expected Returns

There is a better way

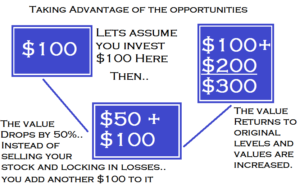

Let me illustrate something for you here. Assume that you had invested $100 in the market at the end of 2007. By the end of 2009 that would have been worth about half as much. Investing more money when it is so far down is exactly the opposite of what most people want to do, but exactly what they should do. I like to use the phrase, “before you through a rock through my window, you better tie another $100 to it because look at what is going to  happen. After just a few years, the market had recovered and for those that held on they gained their money back, but for those that re-adjusted they made much more than their money back, they cashed in on one of the best bull markets in history. That is exactly how we are able to get 11-14% for our clients instead of the 4.5% that the average Self-manager is able to do. There is a better way.

happen. After just a few years, the market had recovered and for those that held on they gained their money back, but for those that re-adjusted they made much more than their money back, they cashed in on one of the best bull markets in history. That is exactly how we are able to get 11-14% for our clients instead of the 4.5% that the average Self-manager is able to do. There is a better way.