At Blue Line ,We believe that you are, more responsible with your money than the healthcare industry is.

There is a better way and we are doing something about it.

How self funded Plan works

Self Funded works differently; here is a textbook definition; Self-funded health care also known as Administrative Services Only (ASO) is a self insurance arrangement whereby an employer provides health or disability benefits to employees with its own funds. ... In self-funded health care, the employer assumes the direct risk for payment of the claims for benefits. In Layman’s terms here’s what you are doing when you buy a self-funded plan. You are buying health insurance with a really high deductible, and then then also you are setting up an account to cover the lower expenses, which is where most of the charges take place. instead of insuring a large pool of people, you only are insuring the people in your group. This makes it so you are not paying the insurance expenses of high cost people who are not in your plan.

Here are the terms to know

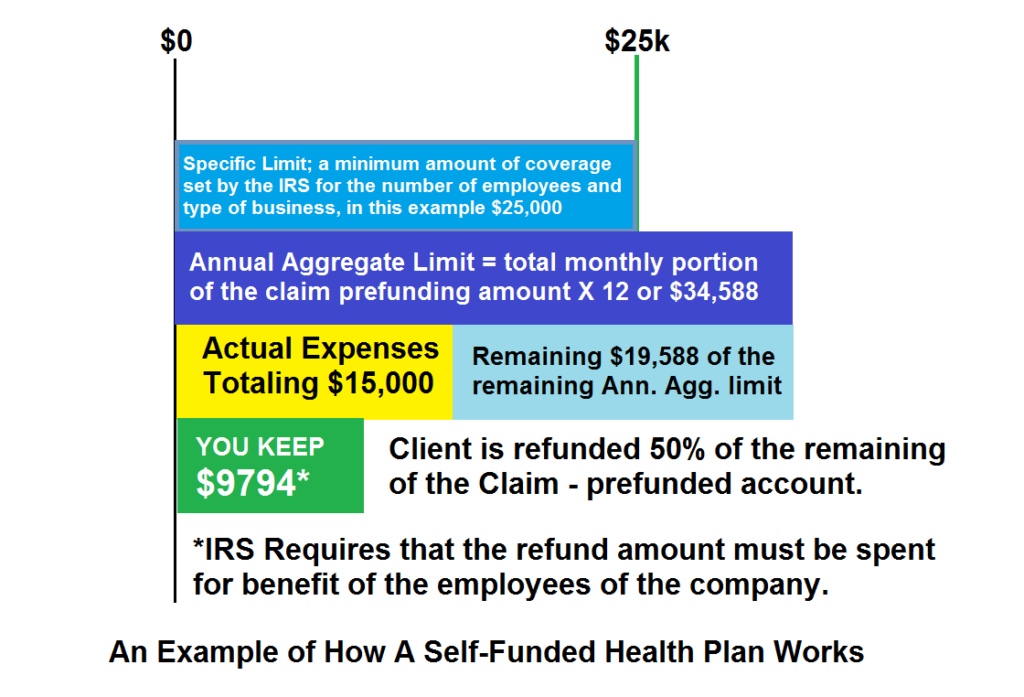

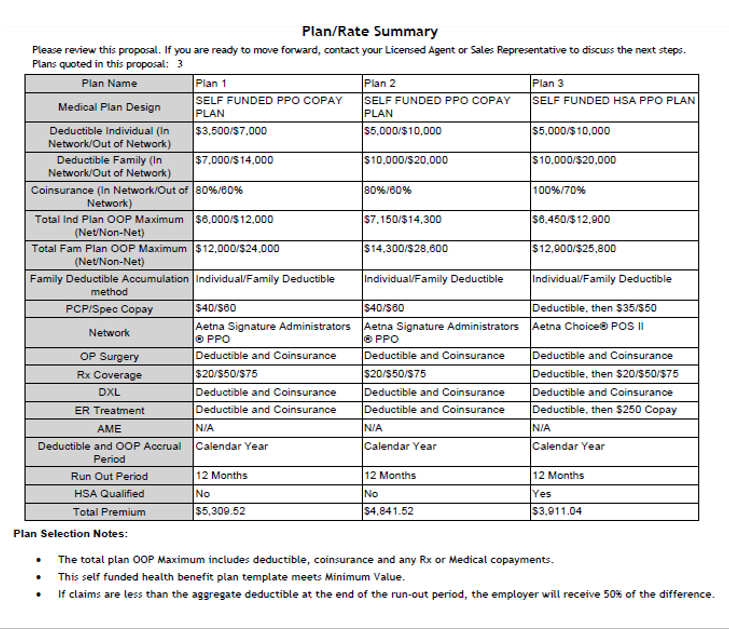

Specific Limit – This is a minimum dollar amount of coverage set By the IRS for the number of employees in your company and the type of company that you have. The law states that each insurance plan needs to cover at least that specific limit, or needs to make that amount available for the paying of insurance expenses of the company every year. A plan with more employees and a more hazardous job description with have a higher specific limit, etc.

.Run – Out Period, typically 12 months. The minimum time that you must keep the plan in place. It takes a year, or a full run-out period in order for the claims prefunding account to be fully funded for paying claims. If there are claims that exceed the saved amount in the first 12 months, they will be covered by the plan administrator. They feel safe doing this because they know that the employer (client) will be a participant of the plan for at least that amount of time and will get their money back. They Plan administrator requires the employer (client) to participate in the plan for the entire Run-out period, which is fair to do so they do not lose money on the plan.

Aggregate Annual Limit. This is claims prefunding times the number of months in the Run-out period. This is shown on the quote to demonstrate that the plan is at least compliant with Federal Regulations Regarding specific limit for the company.

How it works.

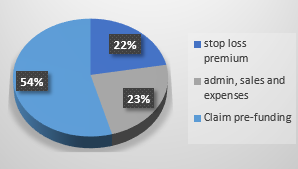

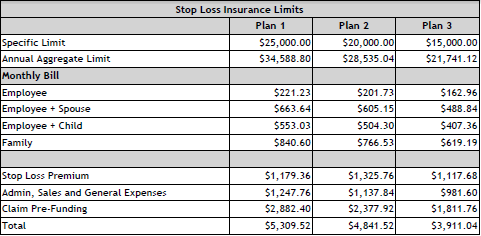

The premium that you pay is divided into 3 parts;

Stop Loss Premium – this is the true insurance part of the plan, all costs above the stop loss amount are fully covered.

Admin, Sales and General Expenses – exactly what it sounds like, this pays Blue Line and the contractor that created and runs the plan.

Claims pre funding – this is a type of internal savings account. Money is set aside into this account to pay medical expenses prior to reaching the stop loss amount.

Self-Funded health care

As health care cost continue to rise more employers will look to alternative ways to finance their healthcare plans. Consumer driven plans have become popular recently as employers look to shift some of the accountability to employees. Self-funded plans take one step further. With a self funded health insurance plan, when you as the business owner pay the premium, it gets divided 3 ways; part goes to the administration costs of the plan, part goes to the actual insurance component and the third part goes to a funding account, which the plan draws on when employees have expenses. The advantage of this is that account builds through the year, and whatever part is not spent gets sent back by check to the employer. Many employers use that money to fund HSA plans or to go towards paying the premiums for the next year, Perhaps the biggest advantage of self-funded plans is transparency of claims data. Self-funded employers who contract a TPA receive a monthly report detailing medical claims and pharmacy costs. Knowing this information becomes instrumental in controlling costs by shifting buying patterns. Other advantages include plan flexibility, access to national PPO networks, and financial savings.

As health care cost continue to rise more employers will look to alternative ways to finance their healthcare plans. Consumer driven plans have become popular recently as employers look to shift some of the accountability to employees. Self-funded plans take one step further. With a self funded health insurance plan, when you as the business owner pay the premium, it gets divided 3 ways; part goes to the administration costs of the plan, part goes to the actual insurance component and the third part goes to a funding account, which the plan draws on when employees have expenses. The advantage of this is that account builds through the year, and whatever part is not spent gets sent back by check to the employer. Many employers use that money to fund HSA plans or to go towards paying the premiums for the next year, Perhaps the biggest advantage of self-funded plans is transparency of claims data. Self-funded employers who contract a TPA receive a monthly report detailing medical claims and pharmacy costs. Knowing this information becomes instrumental in controlling costs by shifting buying patterns. Other advantages include plan flexibility, access to national PPO networks, and financial savings.

.

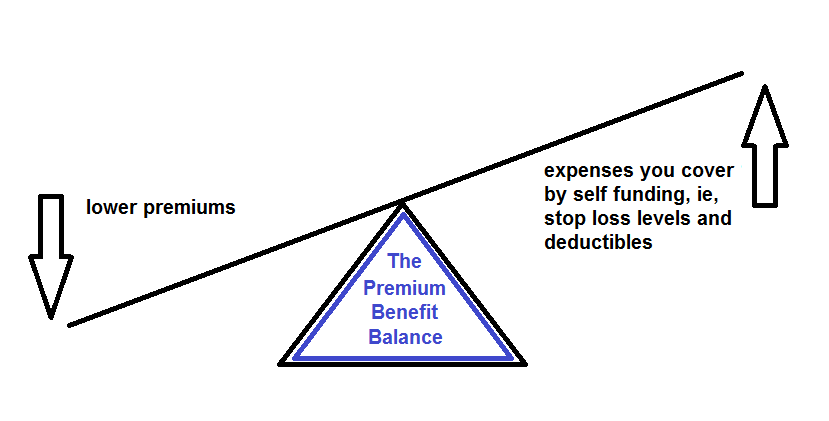

Fully Funded vs Self funded

Difference between Self funded and a fully funded plan. Part of the problem lies in the difference between two different types of plans, a “fully funded” and a “self funded” insurance plan.

A fully funded plan means that the insurance company covers everyone in the group, which is a group that includes not just the people at your company, but everyone, for everything. That means that they are using that premium to insure the risk of the chronically ill, pregnancies, cancer treatments, etc that likely have nothing to do with anyone in your firm. Also in the experience of Blue Line, there is a double standard for medical expenses that doctors charge. For example, most doctors, if they find out that a patient has no insurance, will charge a reduced rate, but will charge the insurance company a much higher rate for the same service. That is not necessarily from any fault of the physician, but that is a set price from the insurance company. All at the expense of the premium payer

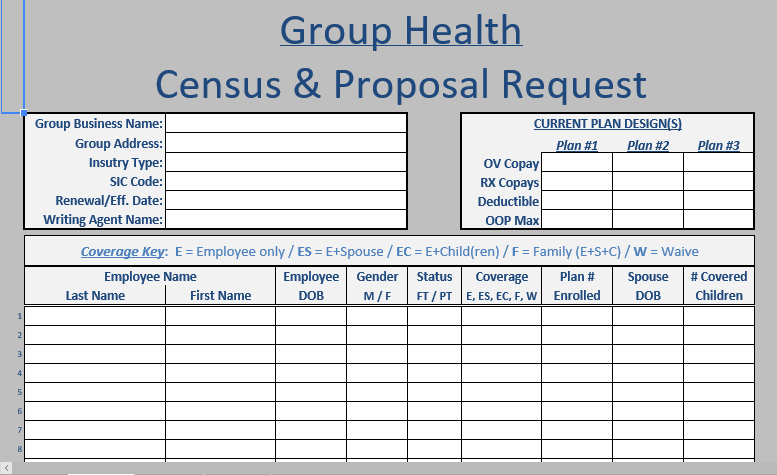

Design your company Plan

Step 1 Understand what your needs are from a budget and coverage perspective

Step 2 Collect Data

Step 3, review the Plan

Pick a date and implement